2024 COmmunity Volunteer Income Tax Program (CVITP)We have wrapped up our Community Volunteer Income Tax Program clinics for 2024. We are thrilled to have been able to file over 265+ returns for community members! Announcing - Summer CVITP Clinics To continue to assist community members who have missed the 2023 filing deadline or have tax returns to file from previous years we will have four tax clinics from June - September 2024. To book an appointment, call 705-306-0565. |

What is the Community Income Tax Program?

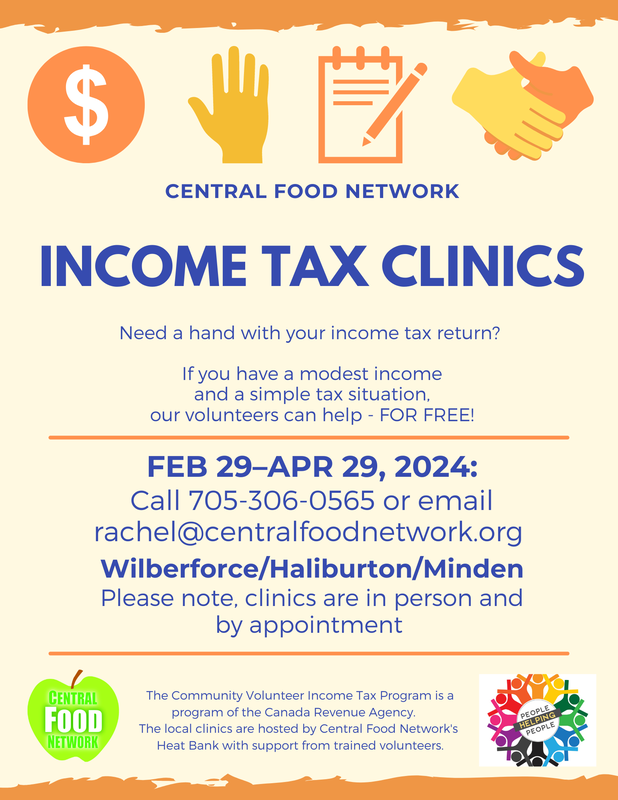

The Community Volunteer Income Tax Program (CVITP) is a Canada Revenue Agency program offered in partnership with community agencies such as ours. The purpose is to assist people with modest incomes and simple tax situations with filing their tax returns in order to access income benefits to which they are entitled.

Our Heat Bank program helps to coordinate the local Income Tax Clinics with support from our team of tax volunteers. Canada Revenue Agency provides tax filing training, support as well as free access to tax software so we can run the program.

Our tax volunteers are not representatives nor staff of Canada Revenue Agency.

Our Heat Bank program helps to coordinate the local Income Tax Clinics with support from our team of tax volunteers. Canada Revenue Agency provides tax filing training, support as well as free access to tax software so we can run the program.

Our tax volunteers are not representatives nor staff of Canada Revenue Agency.

Why is this program so important?

For households struggling with low-income, every dollar is urgently needed to cover essentials like food, clothing, and utilities. While there are a variety of provincial and federal benefits that households are eligible for, many of these supports, such as Canada Child Benefits and Guaranteed Income Supplement, are dependent on tax filing. So we look at tax filing assistance as one of the tools to improve people's situations and reduce their need to turn to our other services.

|

|